The Fastest Way to Fund and Fuel Your Business

Prequalify for real capital offers.

NO hidden fees, no credit score impact, no waiting.

10,000+ Businesses

Trusted by thousands of businesses.

40+ Languages

Funding shouldn’t have language barriers.

MORE capital, LESS RED TAPE

The Fastest, and Smartest way to Fund your Business

We’ve spent years mapping lender requirements, approval patterns, and underwriting preferences. Now, our platform uses that data to instantly match you with the right lenders. Eliminating weeks of back-and-forth into a process that can fund you in hours.

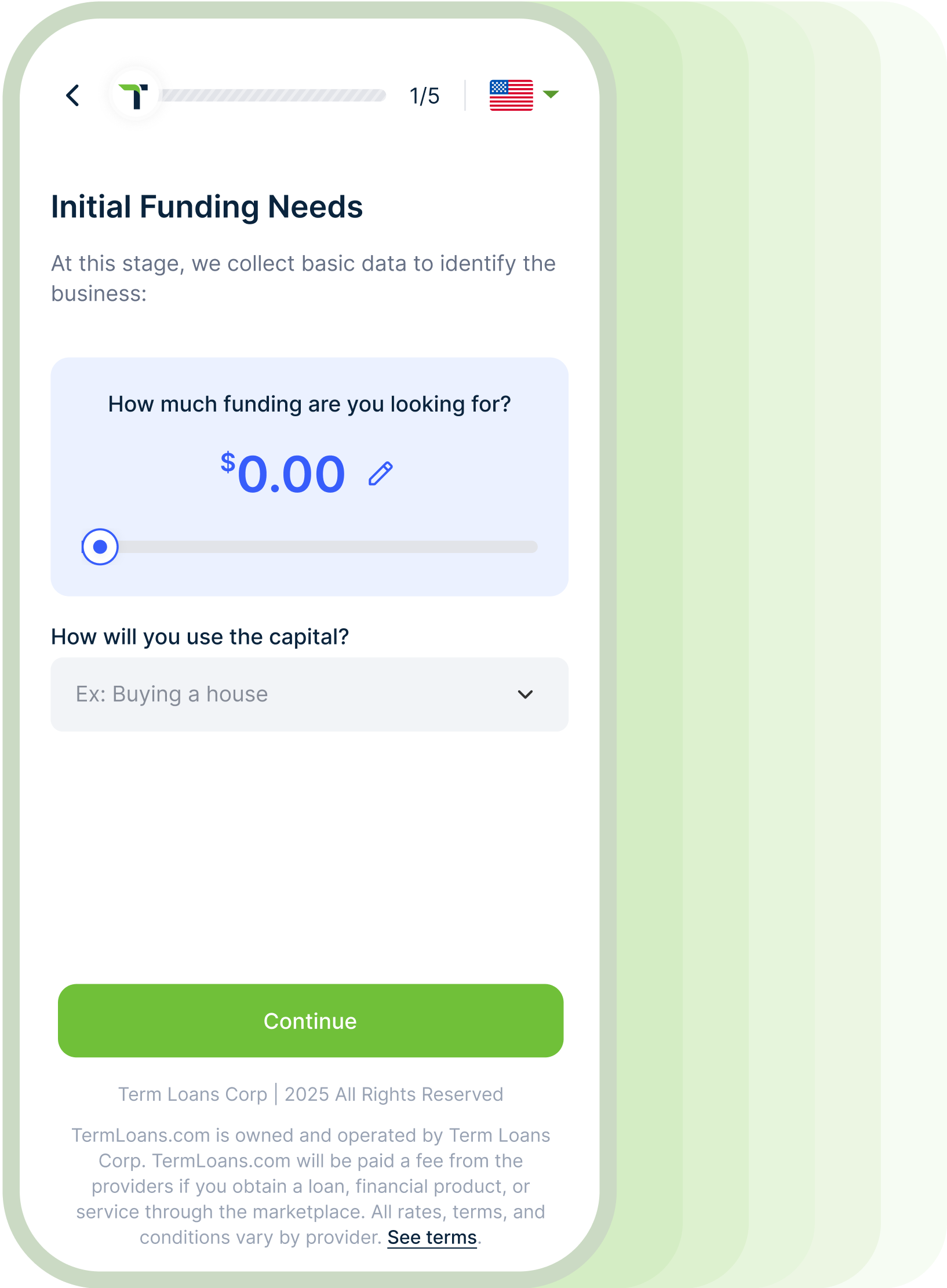

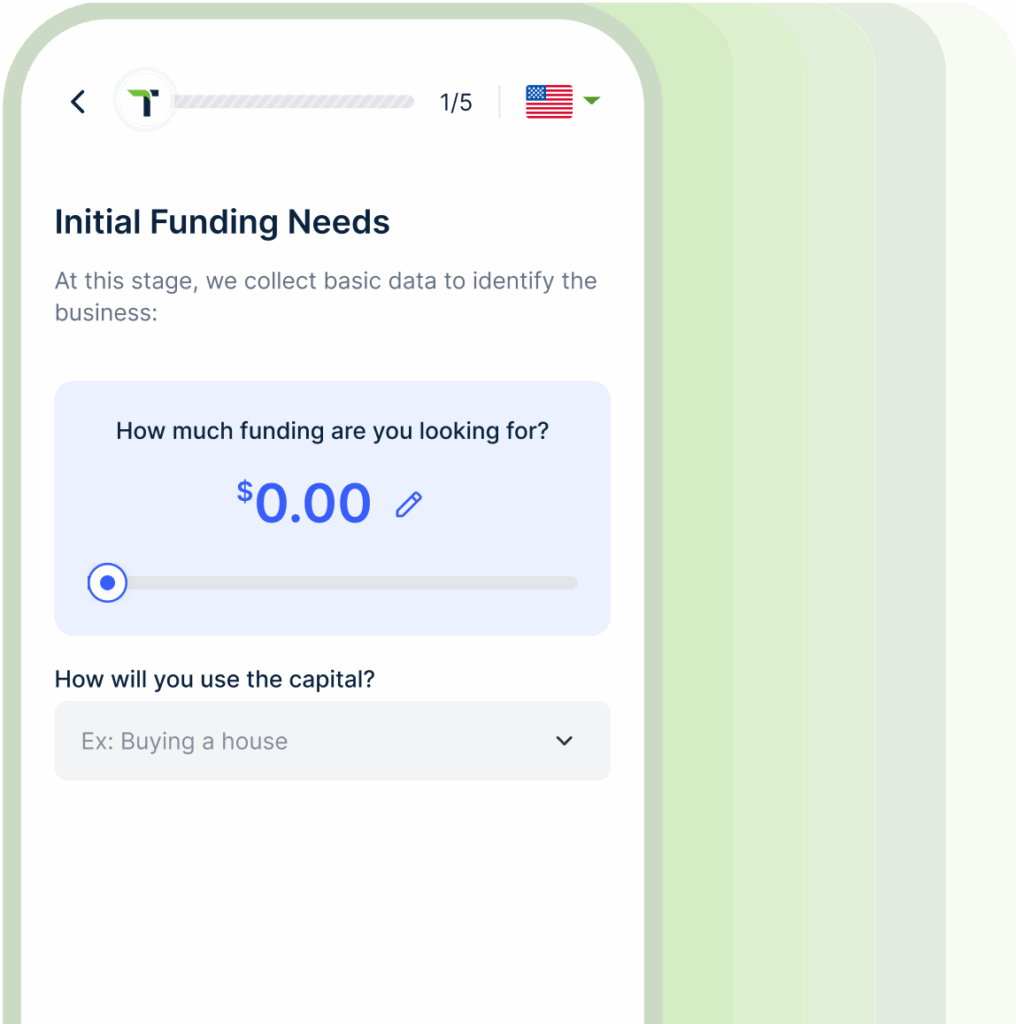

Step 1 - Company Information

Fill out your information

Answer a few quick questions about your business—no credit score impact, no obligations. We use this info to match you with offers you actually qualify for.

Share Your Business Details

Takes less than 2 minutes—no lengthy paperwork

No Risk in Searching

No impact to your credit

Apply Securely

No impact to your credit

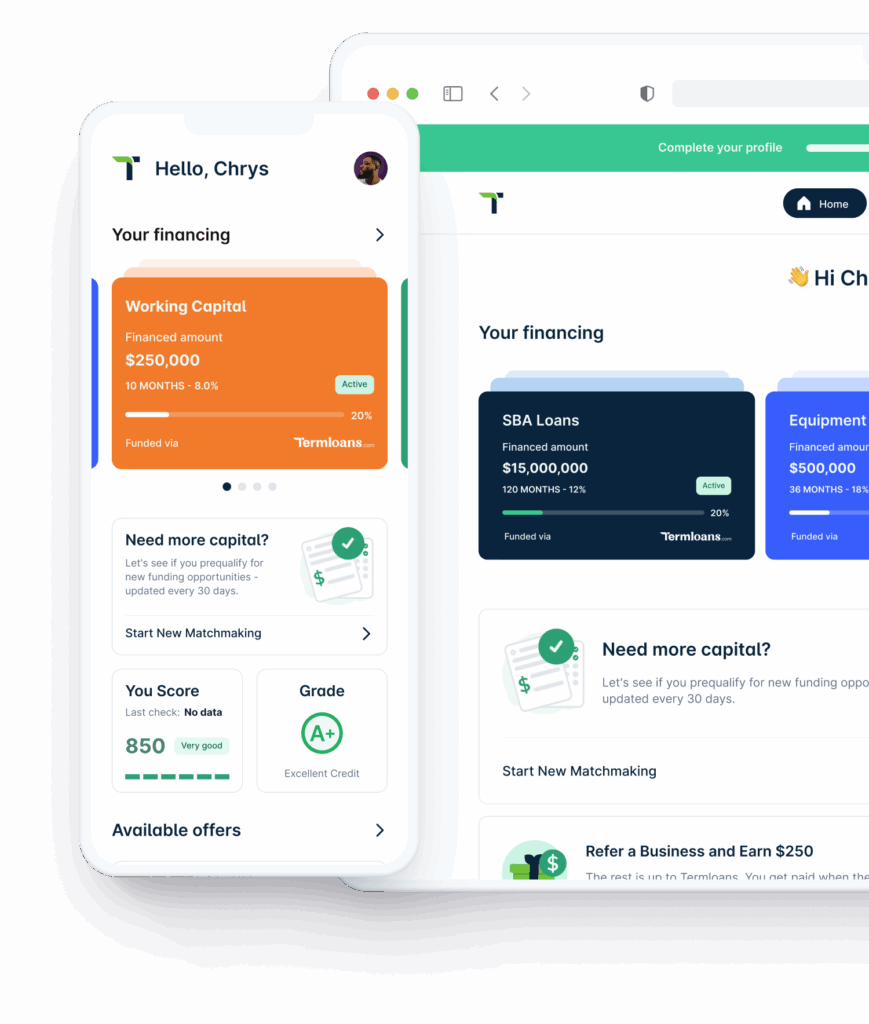

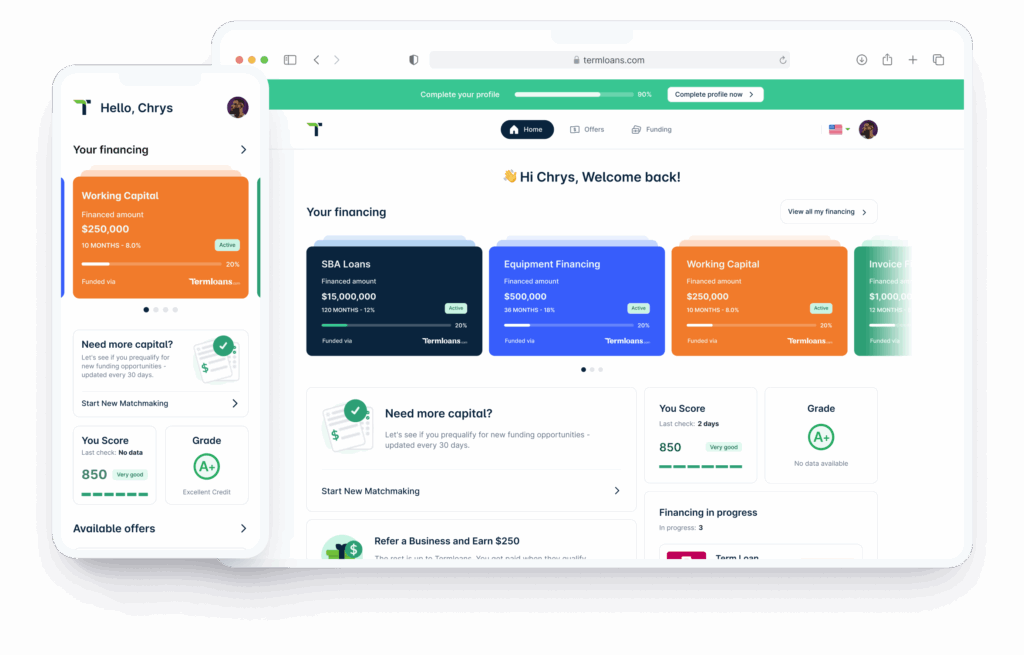

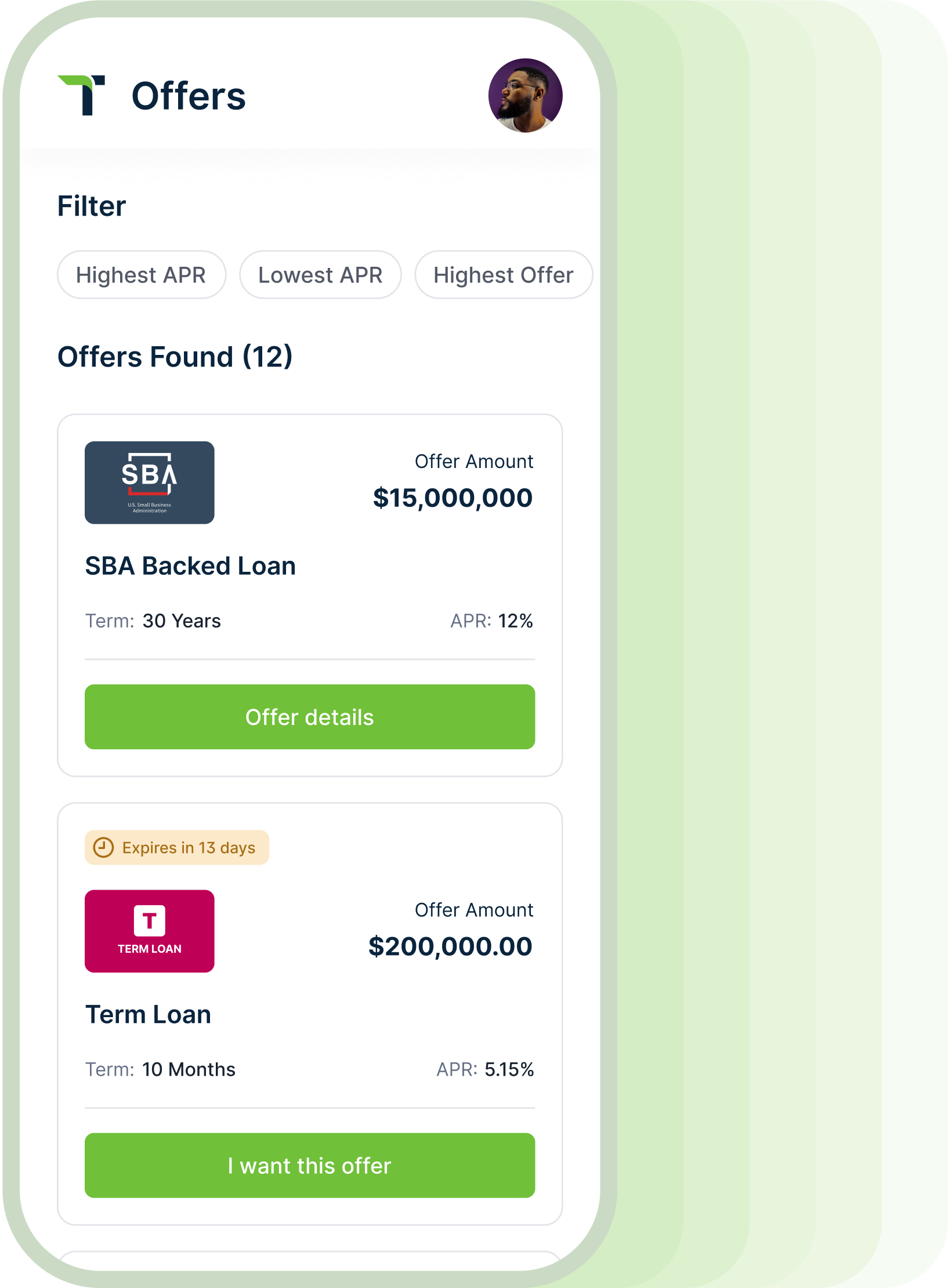

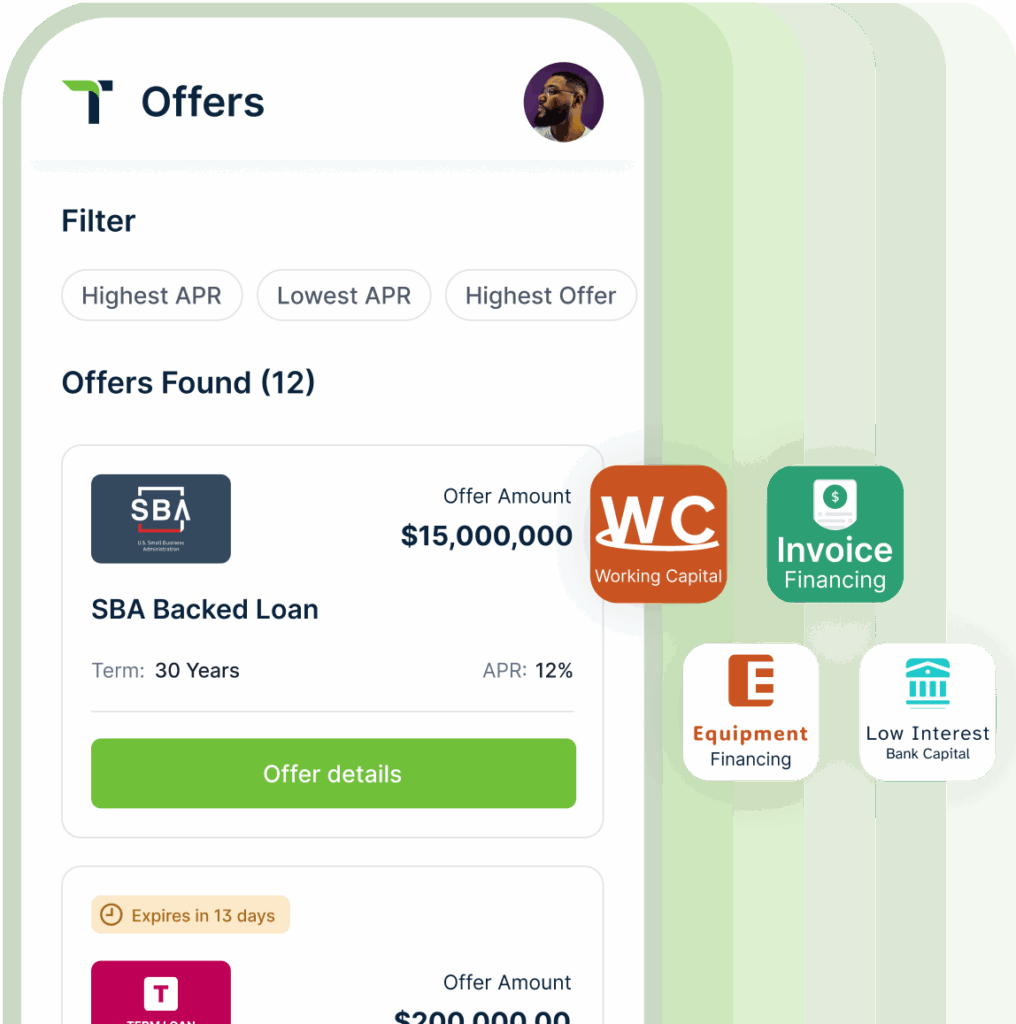

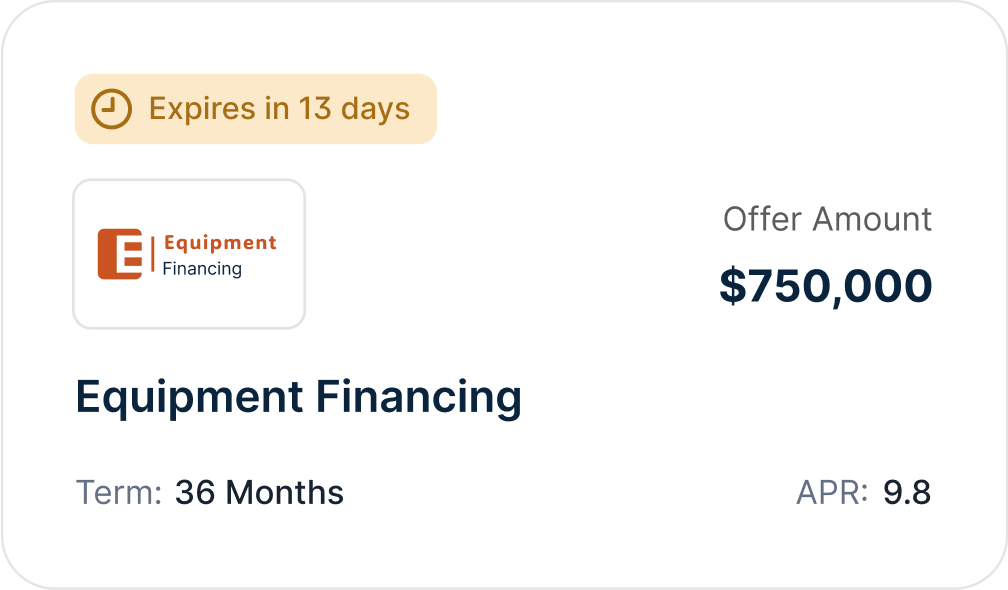

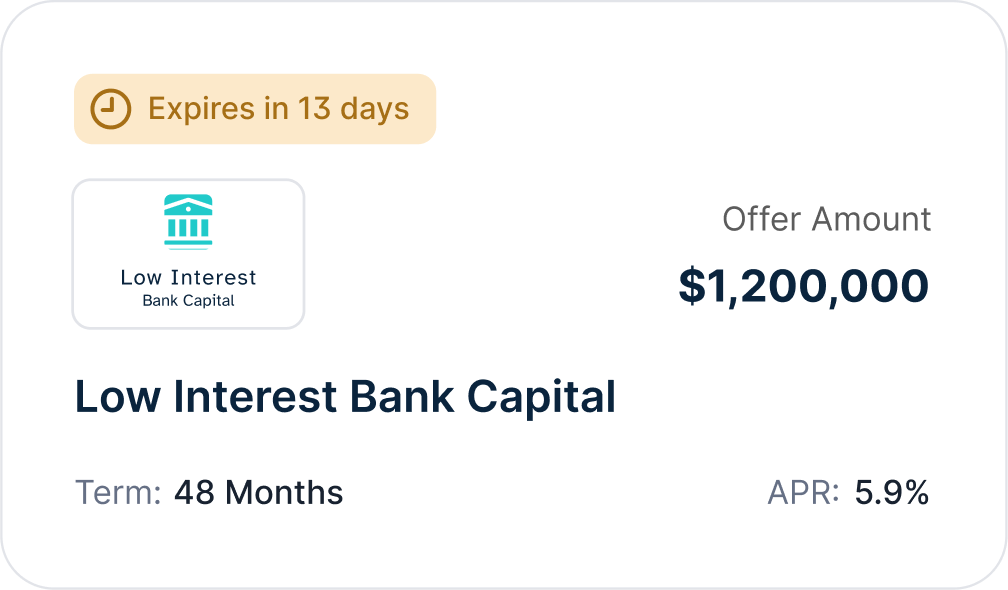

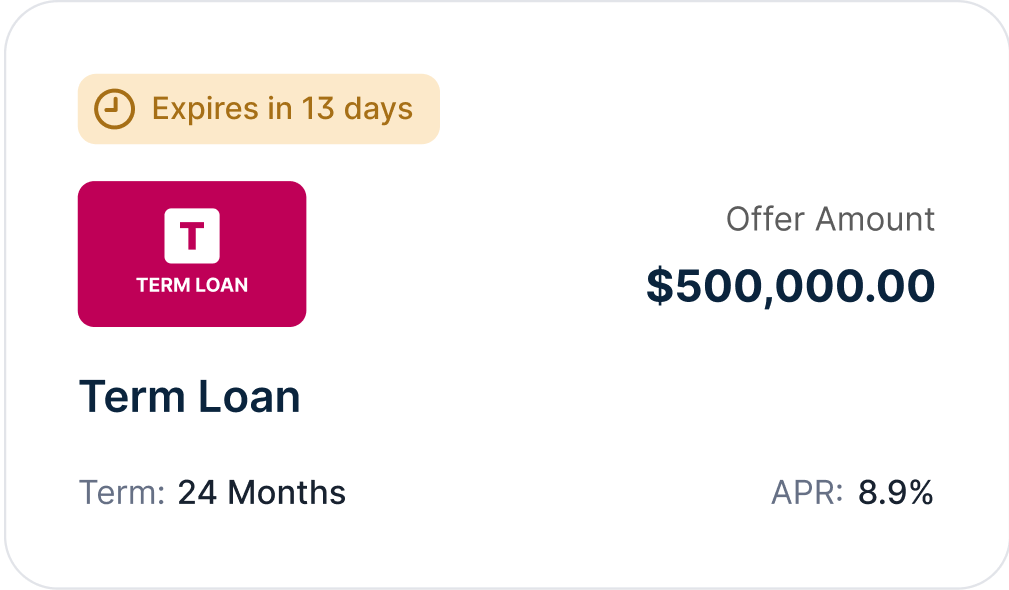

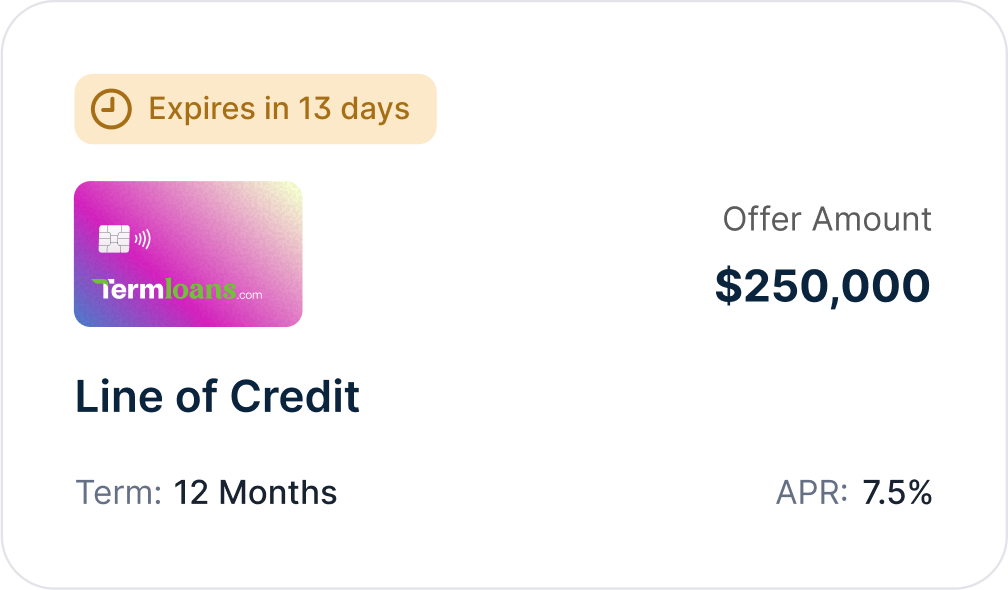

STEP 2 - Review Funding options

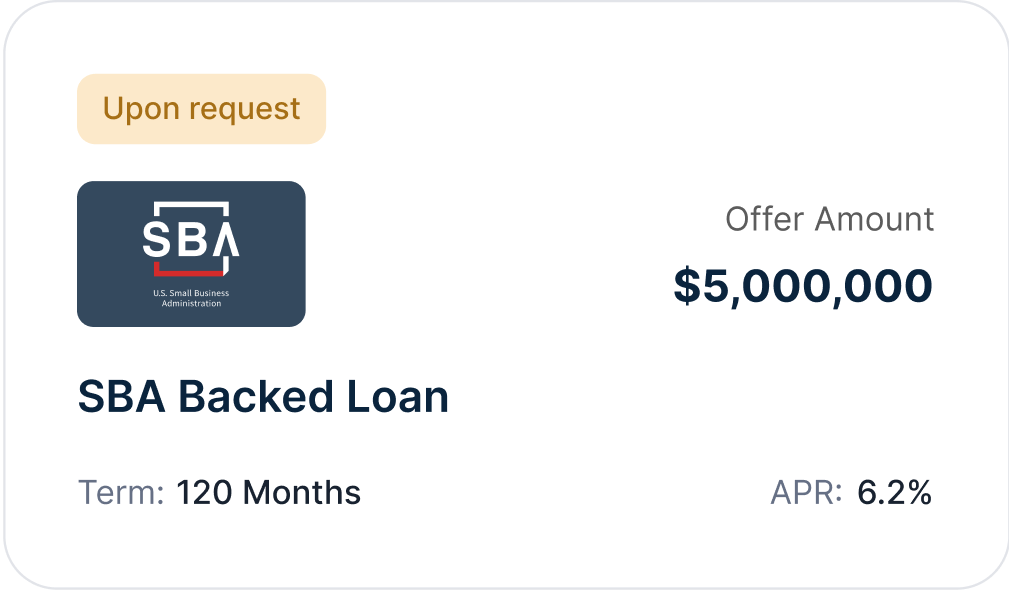

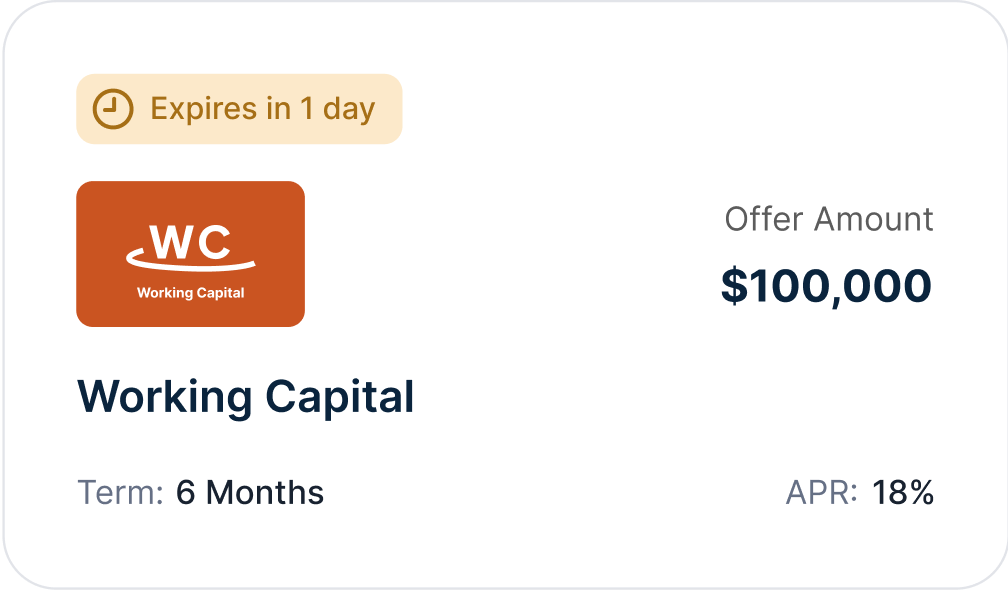

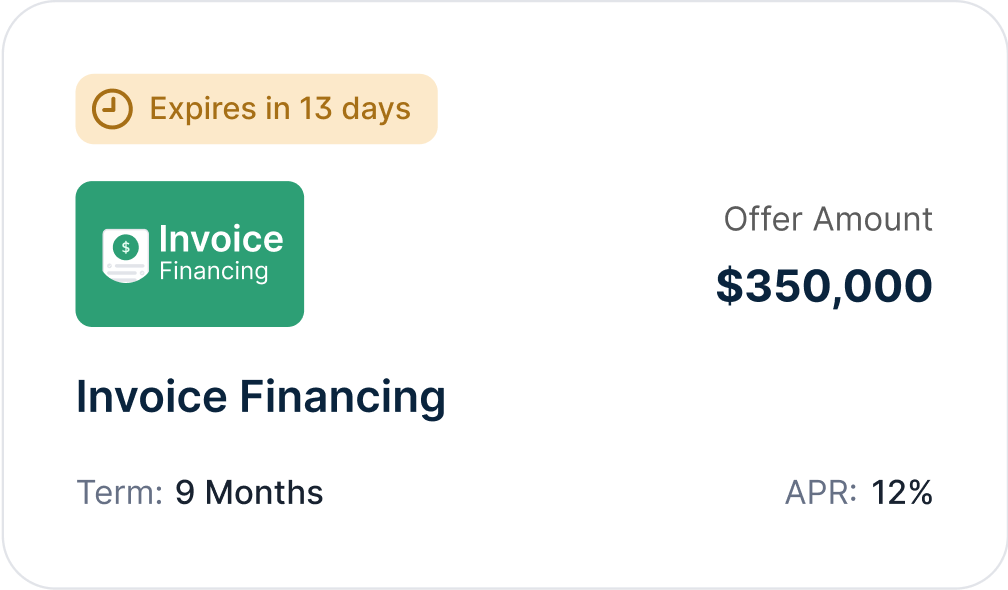

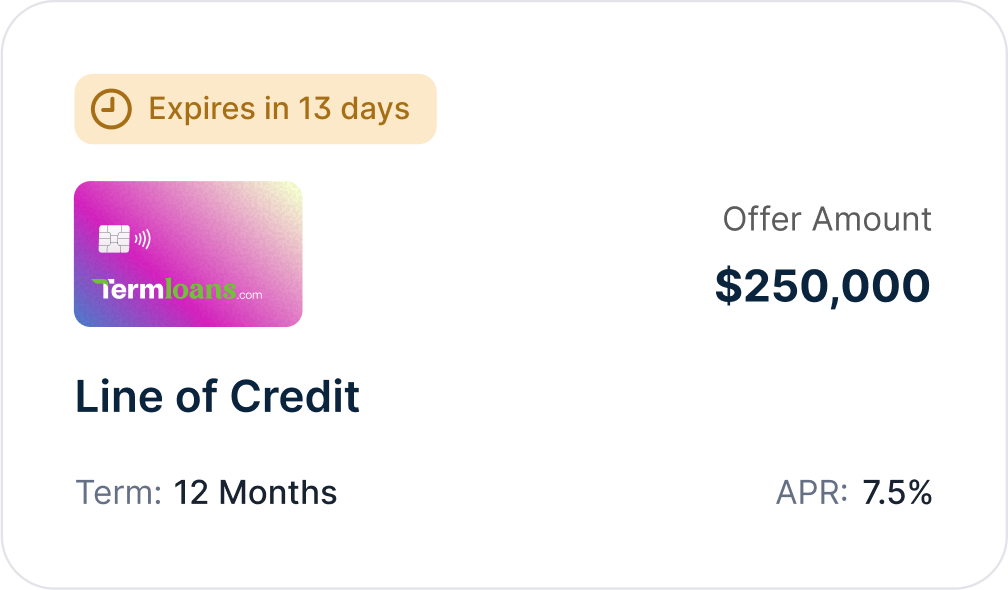

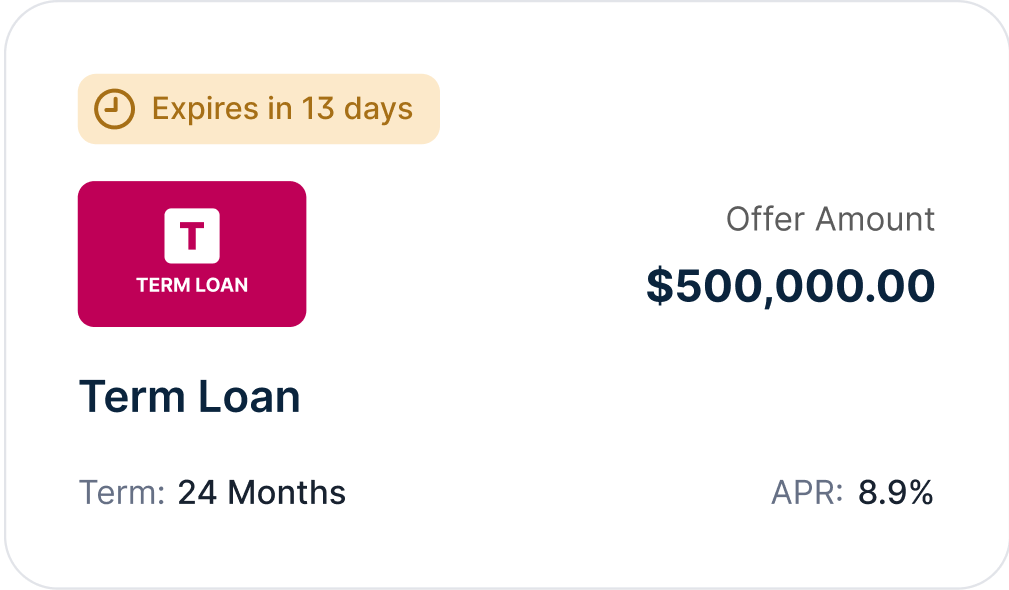

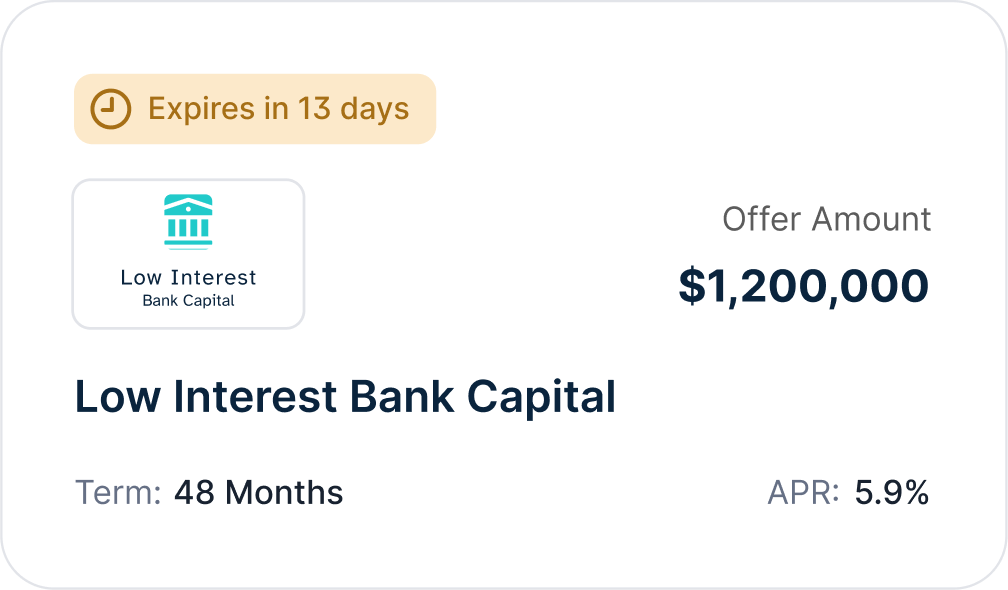

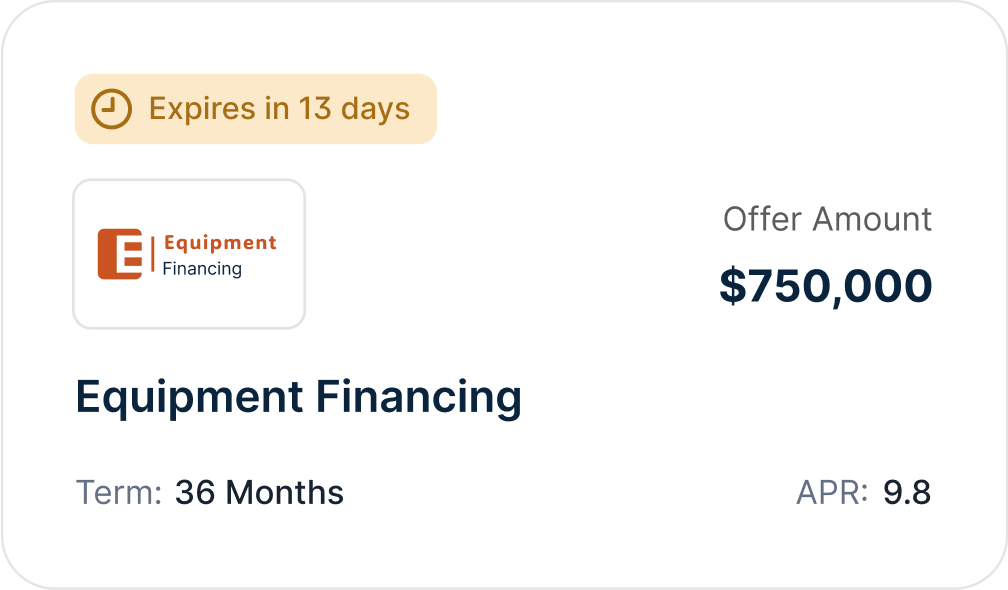

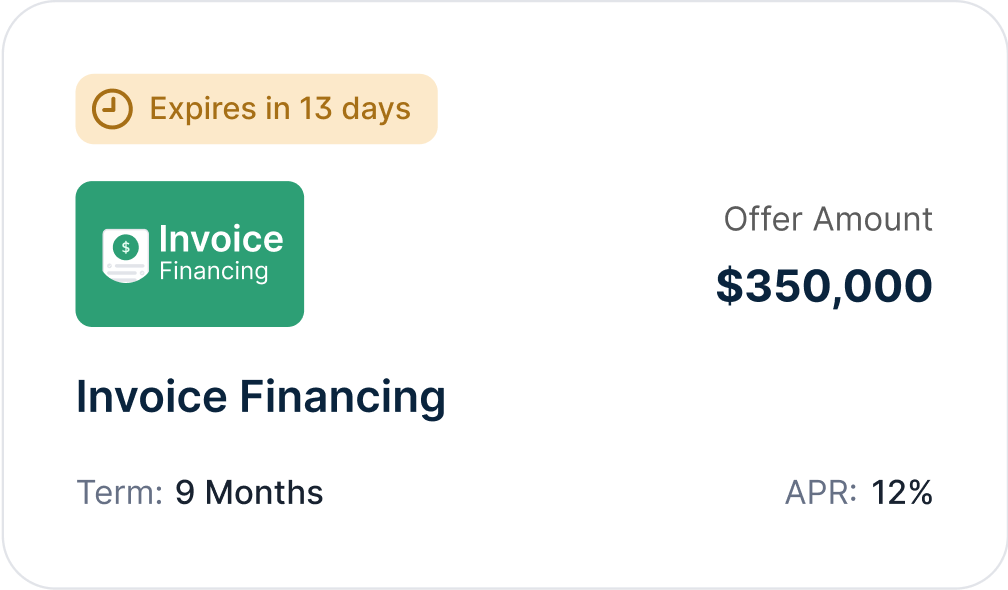

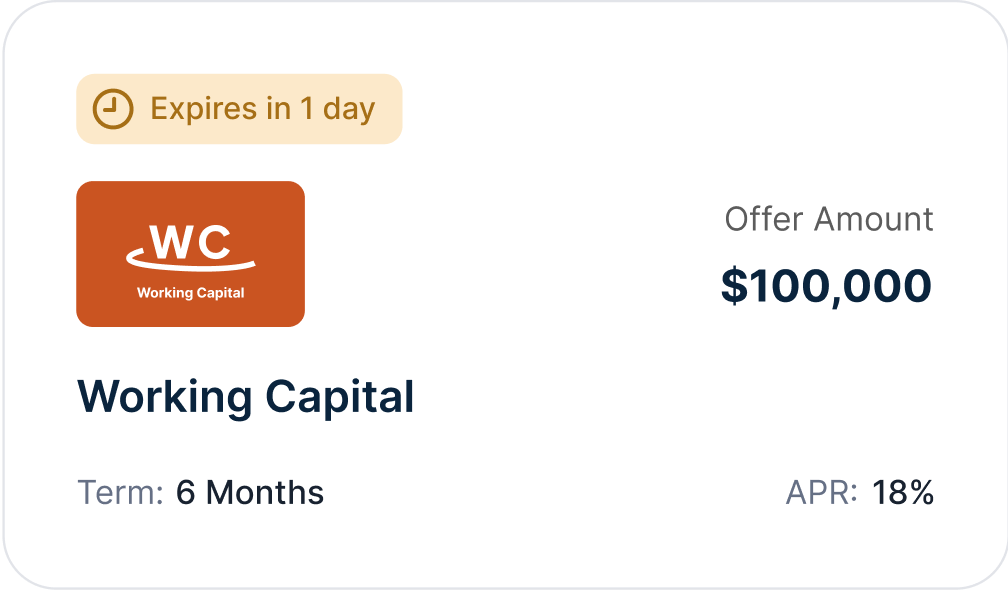

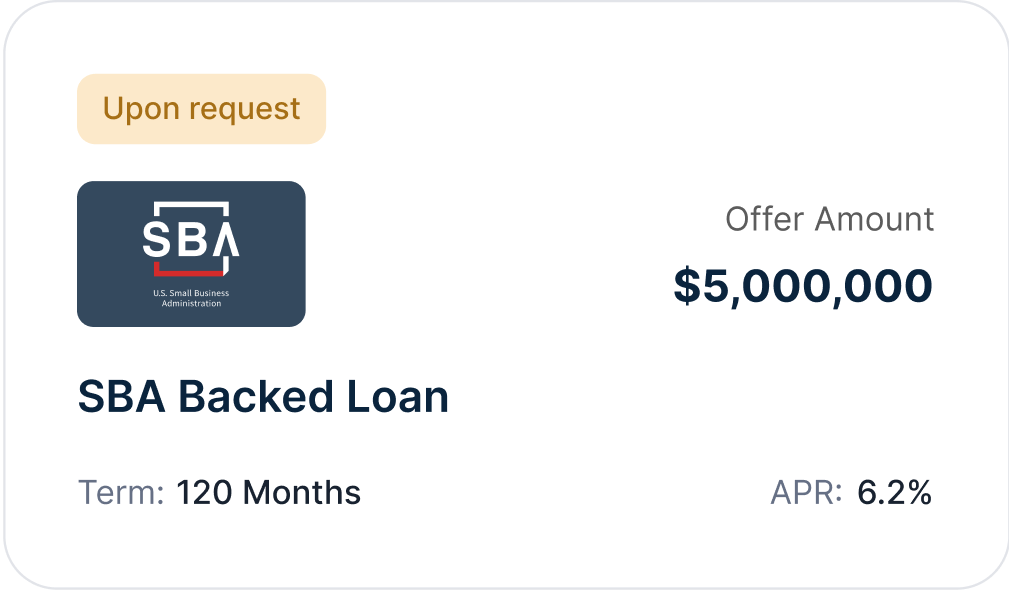

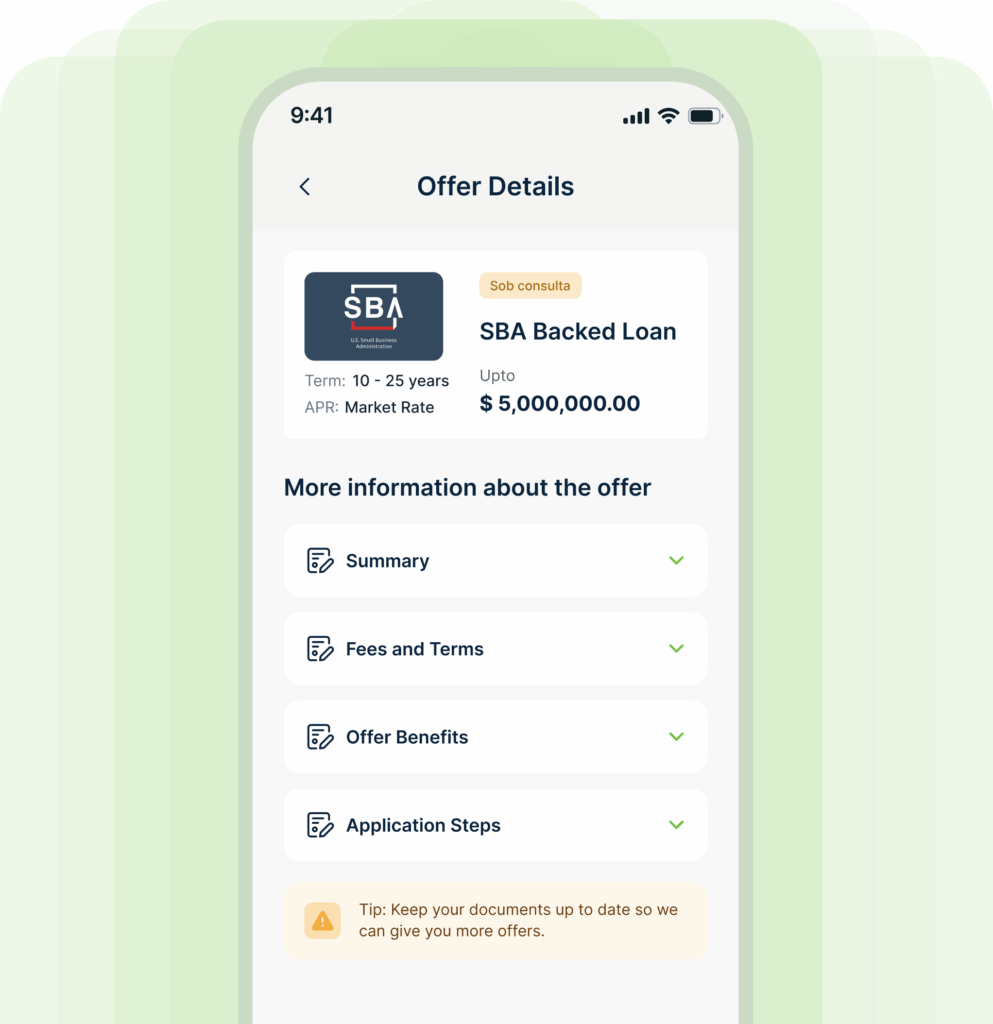

Compare Capital Products

Securely connect and instantly see your best matches. Compare rates, terms, and amounts side-by-side for loans, lines of credit, SBA, RBF, and equipment financing — all in one place!

Find the Right Fit

Access trusted lenders in one place

Compare Your Best Options

See rates, terms, and approvals side-by-side

No Hidden Agenda

Choose from multiple funding types: loans, lines of credit, RBF, SBA, equipment financing, and more

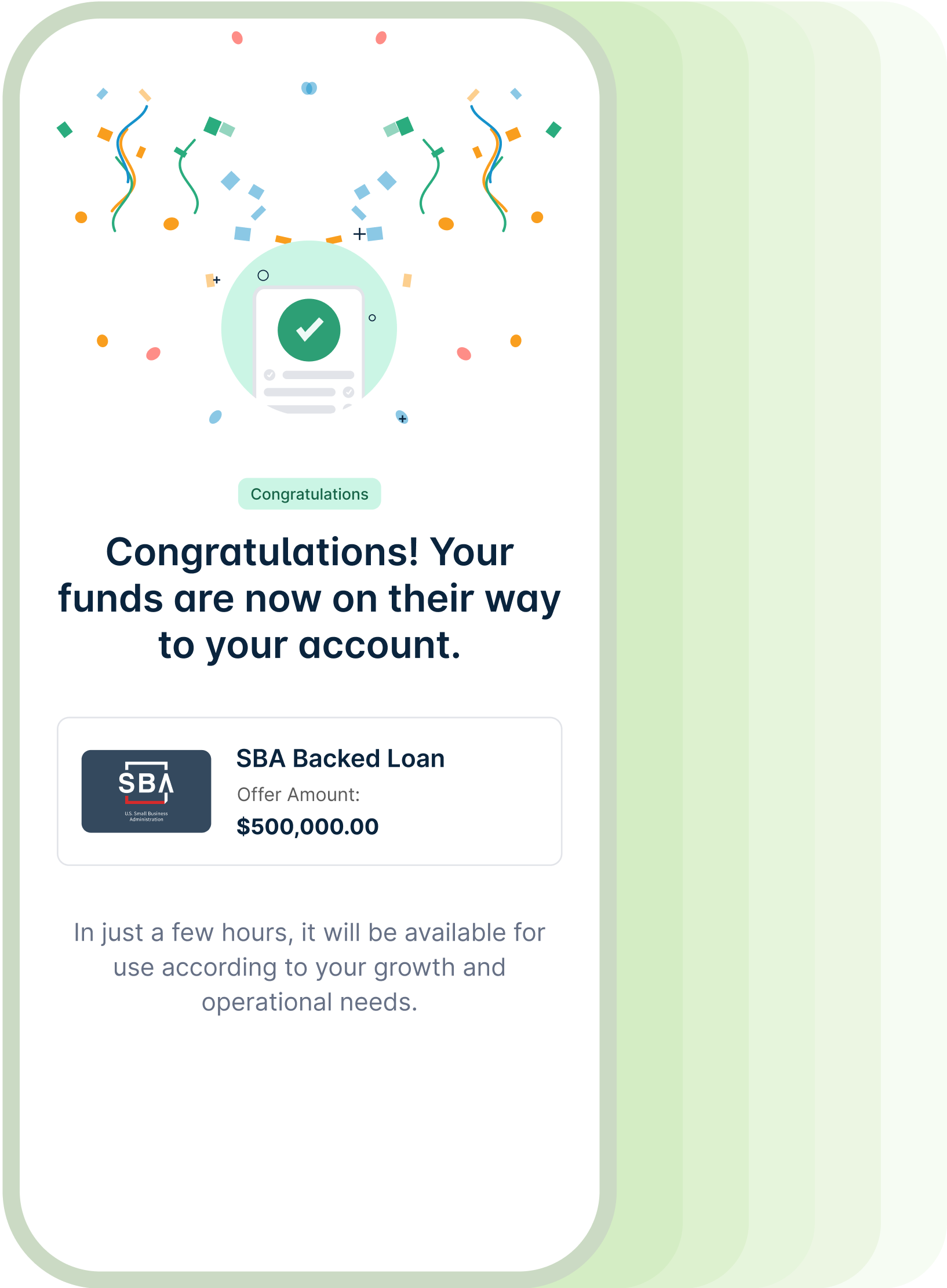

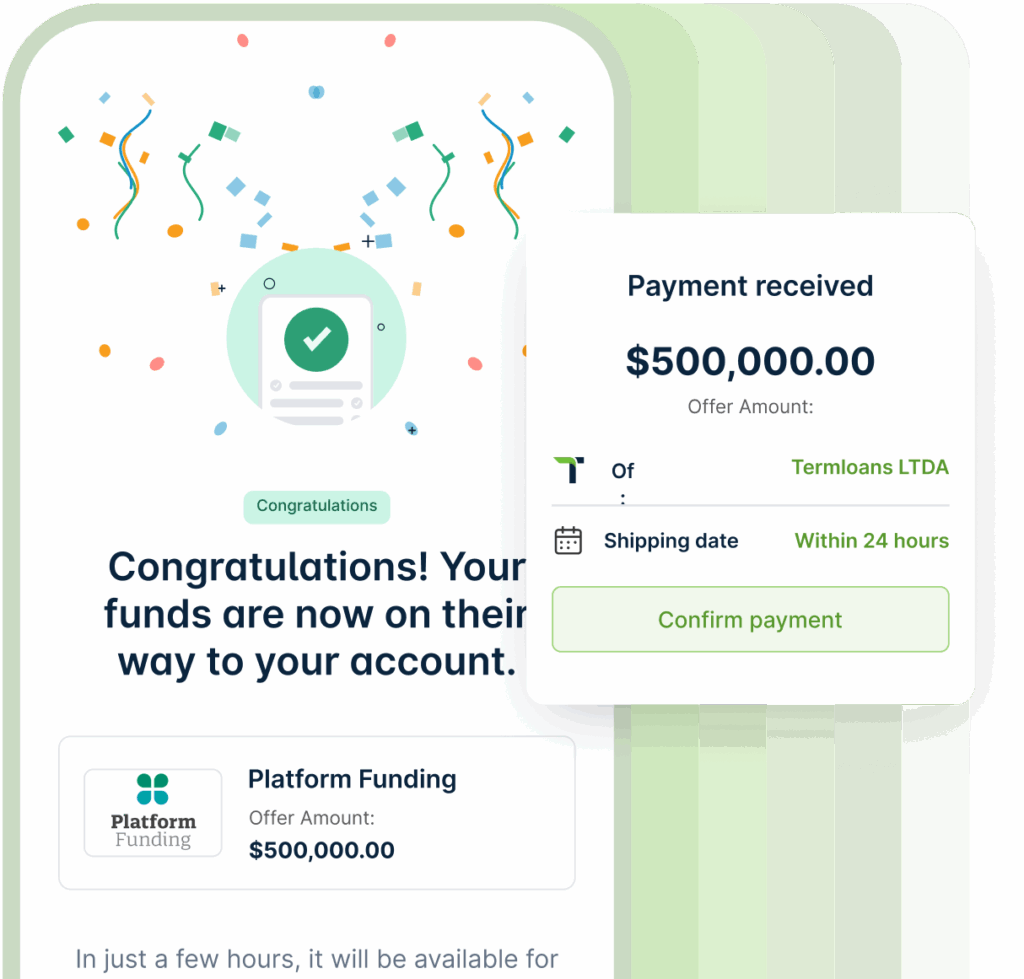

Step 3 - weeks of time saved

Receive Capital

Once you choose an offer, complete the streamlined approval process and access your funds—often in as little as a few hours.

Direct Deposit

Funds deposited directly into your account

Experts Available to Help

Support team guides you from approval to funding

Same Business Day Funding

Many businesses funded the same day

Step 1 - Company Information

Fill out your information

Answer a few quick questions about your business—no credit score impact, no obligations. We use this info to match you with offers you actually qualify for.

Share Your Business Details

Takes less than 2 minutes—no lengthy paperwork

No Risk in Searching

No impact to your credit

Apply Securely

Safe and secure form with bank-level encryption

STEP 2 - Review Funding options

Compare Capital Products

Securely connect and instantly see your best matches. Compare rates, terms, and amounts side-by-side for loans, lines of credit, SBA, RBF, and equipment financing — all in one place!

Find the Right Fit

Access trusted lenders in one place

Compare Your Best Options

See rates, terms, and approvals side-by-side

No Hidden Agenda

Choose from multiple funding types: loans, lines of credit, RBF, SBA, equipment financing, and more

Step 3 - weeks of time saved

Receive Capital

Once you choose an offer, complete the streamlined approval process and access your funds—often in as little as a few hours.

Direct Deposit

Funds deposited directly into your account

Experts Available to Help

Support team guides you from approval to funding

Same Business Day Funding

Many businesses funded the same day

Security You Can Trust

Advanced Encryption and 24/7 Monitoring for Maximum Data Safety

We protect your data with AES-256 encryption and TLS 1.2, coupled with 24/7 threat monitoring, multi-factor access control, and regular third-party audits. This allows us to ensuring round-the-clock protection and compliance.

About Us

The Fastest Way to Fund and Fuel Your Business Next FAQ

Check out the most frequently asked questions here

Didn't find your question here?

Talk to our team of experts for personalized guidance.

What type of credit score do I need to qualify for funding?

At Termloans.com we cater to both individuals with good and bad credit. We understand that your credit score is just one aspect of your financial health. Our goals is to find the best loan terms and highest amounts by setting up your file for success, regardless of your credit score.

How does Termloans.com ensure it finds the best loan terms for me?

We utilize a thorough process where we shop around with multiple lenders to compare loan terms. This approach allows us to secure the most favorable rates and terms tailored to your unique financial situation, ensuring your application is positioned for the best possible outcome.

What information do I need to provide to apply for funding?

To streamline the funding process and increase your chances of success, you’ll need to provide basic personal information, details about your business, including financial statements, not including tax returns but preferred. This information helps us tailor our search for the best loan terms specifically for you.

How long does the funding process take?

The timeline can vary depending on the complexity of your file and the type of funding you are seeking. Typically, the process from application to receiving funds can take anywhere from a few days to several weeks. We strive to expedite your application while ensuring thorough consideration is given to securing the best terms.

What should I do if I have previously been denied?

Don’t be discouraged! We specialize in setting up files for success, even for clients who have faced denials in the past. We recommend discussing your previous application with us so we can understand any potential issues and adjust your new application accordingly, improving your chances of approval.

About Us

The Fastest Way to Fund and Fuel Your Business Next FAQ

Check out the most frequently asked questions here

What type of credit score do I need to qualify for funding?

At Termloans.com we cater to both individuals with good and bad credit. We understand that your credit score is just one aspect of your financial health. Our goals is to find the best loan terms and highest amounts by setting up your file for success, regardless of your credit score.

How does Termloans.com ensure it finds the best loan terms for me?

We utilize a thorough process where we shop around with multiple lenders to compare loan terms. This approach allows us to secure the most favorable rates and terms tailored to your unique financial situation, ensuring your application is positioned for the best possible outcome.

What information do I need to provide to apply for funding?

To streamline the funding process and increase your chances of success, you’ll need to provide basic personal information, details about your business, including financial statements, not including tax returns but preferred. This information helps us tailor our search for the best loan terms specifically for you.

How long does the funding process take?

The timeline can vary depending on the complexity of your file and the type of funding you are seeking. Typically, the process from application to receiving funds can take anywhere from a few days to several weeks. We strive to expedite your application while ensuring thorough consideration is given to securing the best terms.

What should I do if I have previously been denied?

Don’t be discouraged! We specialize in setting up files for success, even for clients who have faced denials in the past. We recommend discussing your previous application with us so we can understand any potential issues and adjust your new application accordingly, improving your chances of approval.

Didn't find your question here?

Talk to our team of experts for personalized guidance.

Didn't find your question here?

Talk to our team of experts for personalized guidance.

Loans made or brokered in Florida are made or brokered pursuant to Florida Commercial Financing Product CS/HB 1353

This site is not a part of the Face book website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

SBA logo used for informational purposes only. TermLoans.com is not affiliated with the U.S. Small Business Administration